Introduction

In the fast-paced world of finance, having the right tools for stock analysis can significantly enhance your investment strategy. As technology continues to advance, artificial intelligence is transforming the way investors analyze market trends, assess risks, and identify opportunities. Whether you’re a seasoned trader, a business owner looking to make informed financial decisions, or a newcomer eager to navigate the stock market, leveraging AI-driven solutions can provide a competitive edge.

In this article, we present the top 8 AI stock analysis tools of 2026, meticulously selected to empower you on your investment journey. Each option has been thoroughly evaluated based on key criteria such as features, pricing, user experience, and overall value, ensuring you have the insights necessary to choose the right solution tailored to your unique needs. Let’s dive in and discover the best AI stock analysis tools that can elevate your investing game.

Website List

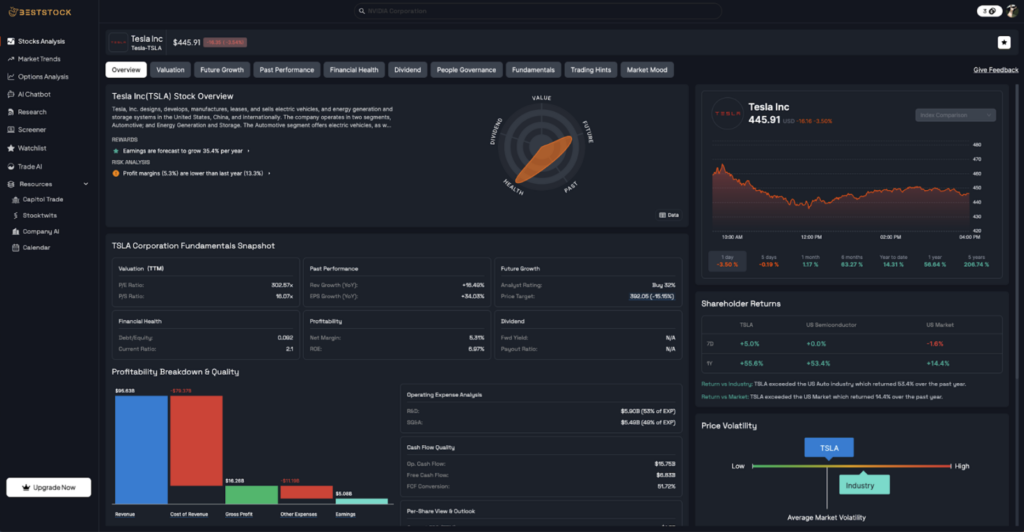

1. BestStock AI

What is BestStock AI

BestStock AI is an AI-powered platform that provides comprehensive financial analysis and market intelligence for investors. By automating data processing and delivering actionable insights, it empowers users to make informed decisions without the need for manual work. With access to detailed corporate financials, earnings transcripts, and curated research, BestStock AI enhances the investment process for both professionals and long-term investors. To further assist in your investment strategy, consider using a stock average calculator to easily determine the average cost of your stock purchases, helping you make more informed trading decisions.

Features

- AI-powered financial analysis that automates data processing and delivers actionable insights effortlessly

- Comprehensive market intelligence with access to full US stock financials and curated research for informed investing

- Advanced statistical and business analysis tools for in-depth evaluation of financial performance

- User-friendly interface designed for both novice investors and seasoned professionals

- Real-time data visualization features to enhance understanding of market trends and capital structures

Pros and Cons

Pros:

- Fast and reliable access to trusted global market data for professionals and investors

- AI-driven financial analysis that automates processing and provides actionable insights

- Comprehensive corporate financial intelligence, including earnings transcripts and curated research

- Advanced data visualization tools that enhance data analysis capabilities

Cons:

- May require a learning curve to fully utilize AI-driven features and tools

- Limited options for customization to tailor the platform to specific investment strategies

- Potential performance issues when accessing data during high-traffic periods

Price

Free

Price: $0/data.87

Features:

- 3 Copilot Prompts/mo

- 2 Investor Relations

Plus

Price: $24.9/data.87

Features:

- 100 shared AI credits per month

- 1Y event history (Calls, Transcripts & Slides)

- 5 Custom Watchlists

- 3 Quarters of Estimates

Premium

Price: $49.9/data.87

Features:

- 500 shared AI credits per month

- 3Y event history (Calls, Transcripts & Slides)

- 15 Custom Watchlists

- Unlimited Estimates

Ultimate

Price: $166.6/data.87

Features:

- 1000 shared AI credits per month

- Copilot: no credits required

- Company AI: 20 credits per report

- All event history (Calls, Transcripts & Slides)

- Unlimited Dashboards & Rows

- Unlimited Watchlists

- Unlimited Estimates

Best for who

- Financial Analysts: Ideal for professionals seeking comprehensive market intelligence and AI-driven insights to enhance their investment strategies and decision-making processes.

- Long-Term Investors: Perfect for individuals focused on building wealth over time, who need reliable and actionable financial data without the hassle of manual analysis.

- Corporate Finance Teams: Excellent for teams requiring in-depth corporate financial intelligence and statistical analysis to inform business strategies and performance assessments.

2. AlphaInsider

What is AlphaInsider

AlphaInsider is an open marketplace that connects traders and investors with a diverse array of trading strategies. The platform enables users to buy, sell, and share effective trading methodologies, empowering them to enhance their investment decisions and optimize their financial outcomes. With a focus on transparency and accessibility, AlphaInsider aims to democratize trading expertise, making it available to both novice and experienced traders alike.

Features

- Intuitive user interface designed to enhance user experience and minimize learning curve

- Robust security protocols that protect sensitive data and ensure compliance

- Comprehensive analytics dashboard for real-time performance tracking and reporting

- Seamless integration with popular third-party applications to streamline workflows

- Mobile accessibility for on-the-go management and team collaboration

Pros and Cons

Pros:

- Gives you the ability to access many of the real-time trading strategies that members of our community are using.

- Provides strategy performance and historical data for strategy analysis aiding users in decision-making.

- Discovers proven strategies from other traders and allows quick testing.

- Integrates with other trading and workflow systems for automated handling.

- Easy interactive interface with filters and sorting to find strategies that meet certain goals or risk profiles.

Cons:

- Overreliance on community-contributed ensembles runs the risk of varying quality or dubious reliability.

- Weak depth of carry on analysis from a fundamental perspective relative to traditional research platforms.

- There are certain features like automation which some of the people might find a bit complex or may even have to do manual settings.

- You may have to pay a subscription service such as the premium plan in order to get all its features, which can become expensive if you only use it casually.

- Perhaps it is more challenging for long-term investors who are looking for insight into fundamentals as opposed to short-term strategy tracking.

Price

- Free Plan: Best for real-time trade alerts, includes 1 broker connection, 1 strategy per broker, increased trading bot leverage, see open orders, private strategies, 10 subscriptions, 5 user strategies, 50 orders per strategy a day, and instant push notifications.

- Pro Plan: $50/month – Ideal for multi-strategy diversification, features 1 broker connection, 100 strategies per broker, increased trading bot leverage, see open orders, private strategies, 100 subscriptions, 50 user strategies, 500 orders per strategy a day, and instant push notifications.

- Premium Plan: $100/month – Best for connecting multiple brokers, includes 5 broker connections, increased trading bot leverage, see open orders, private strategies, unlimited subscriptions, 100 user strategies, unlimited orders per strategy a day, and instant push notifications.

Best for who

- Traders and investors looking to browser, filter and compare real time trading strategies shared by other users, with full transparent history results.

- Users who want community‑derived strategy discovery and social validation of trading approaches, rather than performing all analysis themselves.

- Active market participants that are looking for automated execution or automation tools to the strategy, which includes performance traceability in the trading bots and workflow integrations.

3. Stockinsights

What is Stockinsights

Stockinsights.ai is an AI-powered platform designed to streamline financial research for value investors by providing deep insights into public company filings and earnings transcripts. Its main purpose is to enhance research capabilities and productivity, allowing users to spend less time on data collection and more on making informed investment decisions, particularly in the US and Indian markets. With features that unlock insights from multiple datasets, Stockinsights empowers investors to navigate complex data and track their portfolio companies effortlessly.

Features

- AI-powered analysis of public company filings and earnings transcripts for enhanced research efficiency

- Comprehensive insights from multiple datasets to support informed investment decisions

- Streamlined due diligence processes that save time and increase productivity

- Real-time tracking of portfolio companies to keep you updated on your investments

- Generative AI features that simplify complex data, making it accessible and actionable

Pros and Cons

Pros:

- AI-powered features enhance research capabilities and productivity

- Comprehensive coverage of US and India markets

- Streamlined due diligence process with insights from multiple datasets

- Tools designed to simplify complex data for informed investment decisions

Cons:

- Limited focus on markets outside the US and India

- Potential reliance on technology may overlook traditional research methods

- Subscription costs may be high for individual investors compared to free resources

Price

- Free

- Price: $0/year

- Features:

- 10 AI-Summaries/month for Earnings Calls

- 10 monthly AI searches: Earnings Calls & 10-Ks

- 8K-Dashboard: Last one day’s 8-Ks

- Watchlists & Alerts: Up to 5 stocks

- Pro

- Price: $200/year

- Features:

- Unlimited AI-Summaries for Earnings Calls

- Unlimited AI-Search over Earnings Calls and 10-Ks

- 8K-Dashboard: Full Access

- Watchlists & Alerts: Up to 700 stocks

- Advanced

- Price: Custom

- Features:

- Custom Screeners

- Custom Data Integrations

- Team Accounts

- Dedicated Support and Consulting

Best for who

- Value Investors: Ideal for individuals focused on long-term investment strategies, seeking in-depth analysis of public company filings and earnings transcripts to make informed decisions.

- Investment Professionals: Best suited for analysts and portfolio managers at top firms who require enhanced productivity and streamlined due diligence processes to track portfolio companies and generate actionable insights.

- Data-Driven Researchers: Perfect for financial researchers and analysts looking to leverage generative AI tools for navigating complex datasets, enabling them to uncover investment opportunities more efficiently.

4. StocksToTrade

What is StocksToTrade

StocksToTrade is an all-in-one trading platform designed to empower traders with the tools and resources they need to succeed in the stock market. It offers a comprehensive suite of features including real-time news, advanced charting, trading guides, and stock scanners, making it ideal for both beginners and experienced traders. With a focus on education and strategy, StocksToTrade helps users develop their trading skills and build effective trading plans.

Features

- Comprehensive educational resources, including beginner guides and trading strategies for all experience levels

- Advanced trading tools, such as real-time Level 2 quotes and stock scanners for informed decision-making

- In-depth analytics on market trends and stock performance to optimize your trading strategies

- Seamless integration of trading functionalities across multiple platforms, including desktop and mobile

- Expert insights into trading psychology and techniques, empowering you to enhance your trading mindset

Pros and Cons

Pros:

- Extensive range of educational resources and guides for traders of all levels

- Comprehensive trading tools including Level 2 quotes and stock scanners

- Support for various trading strategies, from day trading to swing trading

- Competitive pricing options that cater to different trading needs

Cons:

- Some advanced features may require a steep learning curve

- Limited customization options for specific trading setups

- Potential performance lags during high-traffic periods on the platform

Price

Price

Trial Options (14-Day Trial)

Limited 14-day trial plans are available to let users test the platform before fully committing:

- Basic Trial: $7 for 14 days

Provides access to the basic platform with very limited features, often without real-time data.

- Trial + Breaking News Chat: $17 for 14 days

Includes access to the live breaking news chat feature.

- Trial + Small-Cap Rockets: $18 for 14 days

Comes with the Small-Cap Rockets scanner, designed to target momentum stocks.

Trials are single-use and intended for evaluation purposes.

Core Subscription Plans

- Monthly Plan: $179.95 per month

Unlimited access to the StocksToTrade platform.

- Three Month Plan: $539.85 every three months

Provides three months of platform access, billed upfront.

- Annual Plan: $1,899.50 per year

Discounted compared to the monthly plan and the most cost-effective long-term option.

Optional Add-Ons

Paid add-ons can extend the functionality of the core platform:

- Small-Cap Rockets

$50 per month or $500 per year

- Breaking News Chat

$49 per month or $490 per year

- TipRanks Integration

$8.95 per month or $89.50 per year

- Level 2 Market Data

$29 per month or $345 per year

These extensions provide additional data, news, and analytical insights beyond the base platform.

Best for who

- Beginner Traders: Perfect for individuals just starting their trading journey who need comprehensive guides and resources to build a solid foundation in trading concepts and strategies.

- Active Day Traders: Ideal for seasoned traders looking for advanced tools and real-time data to execute trades efficiently, manage risks, and capitalize on market movements.

- Financial Educators: Excellent choice for educators and mentors seeking reliable content and resources to teach others about trading strategies, market analysis, and investment psychology.

5. Stockpulse

What is Stockpulse

Stockpulse is a cutting-edge platform that leverages artificial intelligence to analyze financial news and social media sentiment, providing real-time insights for smarter investment decisions. Its primary purpose is to assist financial institutions in enhancing market analysis, risk assessment, and regulatory compliance by monitoring social media for actionable data. By offering concise AI-generated summaries and sentiment analyses, Stockpulse empowers clients to make more informed financial choices and maintain market integrity.

Features

- Advanced AI-driven sentiment analysis that monitors social media for actionable insights in real-time

- Comprehensive reporting capabilities that provide thousands of concise summaries for enhanced market analysis

- Robust fraud detection and market manipulation alerts to ensure regulatory compliance and integrity

- Tailored solutions for financial institutions to optimize risk assessment and decision-making processes

- Seamless integration with existing financial platforms for streamlined operations and improved insights

Pros and Cons

Pros:

- Provides real-time insights from social media to inform financial decisions

- Enhances regulatory compliance and market integrity through advanced AI monitoring

- Offers concise, daily reports that improve market analysis and risk assessment

- Integrates seamlessly with existing financial institutions’ workflows

Cons:

- May require significant investment for implementation and ongoing use

- Potential limitations in offline data access or functionality

- Dependence on social media data could lead to biases in sentiment analysis

Price

- Basic: €29.99 per month

- Included features: 60k stocks, 40 global markets, commodities, currency pairs, current market mood in social media, social media alerts

- Premium: €199.00 per month

- Included features: Full coverage (stocks, global markets, indices, lists, commodities, currency pairs, authors), historical data, watchlist AI alerts

- Platinum: €499.00 per month

- Included features: Full coverage (stocks, global markets, indices, lists, commodities, currency pairs, authors), historical data + download options, real-time, AI stock alerts

- Professional: €1,199.00 per month

- Included features: Full coverage (stocks, global markets, indices, lists, commodities, currency pairs, authors), extensive history + download options, many smart filters, AI and Buzz Alerts

All pricing tiers are billed monthly.

Best for who

- Financial Institutions: Ideal for banks and investment firms seeking to enhance compliance and decision-making through real-time social media insights that detect market manipulation and fraud.

- Risk Assessment Teams: Perfect for professionals who need to leverage AI-generated summaries for financial instruments, allowing for improved market analysis and more accurate risk evaluations.

- Trading Analysts: Excellent choice for analysts who require timely, actionable insights from social sentiment to inform trading strategies and optimize portfolio performance.

6. Stockgeist

What is Stockgeist

Stockgeist is a cutting-edge market sentiment tracking platform that leverages AI deep learning to analyze social media posts about 2,200 publicly traded companies in real time. By providing traders with actionable insights on market sentiment, Stockgeist empowers them to make informed investment decisions and better predict stock movements. Its innovative tools, including a financial chatbot, enhance user experience and offer valuable guidance for both individual traders and hedge fund managers.

Features

- Advanced sentiment analysis tools to uncover historical patterns and compare metrics across companies

- Expanded company coverage across diverse industries for a more comprehensive investment landscape

- Intuitive portfolio management system to track stock performance, sentiment, and social media activity in real-time

- Smart message content analysis to discover insights on topics that matter to you from social media discussions

- User-friendly interface designed for an enhanced and personalized Stockgeist experience

Pros and Cons

Pros:

- Innovative AI-driven analysis of social media sentiment for 2200 publicly traded companies

- Provides real-time insights through a financial QA chatbot

- Enhances hedge fund performance by predicting market shifts

- User-friendly interface that simplifies data interpretation

Cons:

- May require a steep learning curve for less tech-savvy users

- Dependence on social media data could limit accuracy in certain contexts

- Limited offline access to features and insights

Price

FREE

Price: $0

Features:

- Past 24 hours of historical sentiment data with 5-minute resolution

- Top 5 companies of our ranking

- Up to 3 companies in the watchlist

- Latest 3 articles for any company with corresponding title sentiments, number of mentions and text sentiment highlighting

- Basic fundamentals for any company

- Hottest topics from social media in past 5 minutes

STARTER

Price: $50

Features:

- All features from the FREE tier

- Past 7 days of historical sentiment data with 1-hour resolution

- Number of companies in the top ranking increased to 10

- Number of watchlist companies increased to 10

- Number of articles increased to 10

- More fundamental metrics

- Hottest topics from social media in past 1 hour

PRO

Price: $100

Features:

- All features from the FREE and STARTER tiers

- Past 30 days of historical sentiment data with 1-day resolution

- Number of companies in the top ranking increased to 20

- Number of watchlist companies increased to 20

- Unlimited number of articles from past 7 days

- All fundamental metrics

- Hottest topics from social media in past 1 day

- Exclusive access to new experimental features

Best for who

- Traders and Investors: Ideal for active traders and investors looking to gain real-time insights from social media sentiment to inform their trading strategies and make timely decisions.

- Hedge Fund Managers: Tailored for hedge fund professionals seeking to enhance portfolio performance by leveraging sentiment data to predict market trends and identify potential investment opportunities.

- Financial Analysts: Best suited for financial analysts needing comprehensive market sentiment analysis to support research, reports, and investment recommendations based on real-time data from diverse social media channels.

7. LevelFields

What is LevelFields

LevelFields is an AI-driven stock trading platform that provides users with advanced tools and data to enhance their trading strategies. Its main purpose is to empower both novice and experienced traders with customizable alerts, comprehensive data analysis, and expert insights, helping them make informed investment decisions. By offering tiered subscription plans, LevelFields caters to varying levels of trading expertise, ensuring that users receive the support and resources they need to succeed in the stock market.

Features

- Flexible subscription plans designed to cater to both DIY investors and those seeking personalized guidance

- Comprehensive access to data and trends with customizable alerts for informed decision-making

- One-on-one training sessions included with Level 2 subscription for optimized platform usage

- Exclusive analyst alerts and investment positioning provided with Level 2 for proactive trading strategies

- Seamless upgrade path from Level 1 to Level 2, ensuring continuity in your investment journey

Pros and Cons

Pros:

- Level 1 Plan offers complete DIY access to all scenarios and data

- Level 2 Plan includes personalized alerts and trade positioning assistance

- Ability to convert from Level 1 to Level 2 with a credit for the remaining subscription

- Comprehensive training available for Level 2 subscribers to optimize platform use

Cons:

- Level 1 subscribers miss out on personal assistance and additional data years

- No downgrade option from Level 2 to Level 1, limiting flexibility

- Higher tier features may not be necessary for all users, leading to potential overspending

Price

Basic Access

- Pricing: $299 per year

- Discount: 75%

- Final Price: $99 (Billed Annually)

- Monthly Equivalent: $25

Premium Access

- Pricing: $1599 per year

- Discount: 20%

- Final Price: $167 (Billed Annually)

- Monthly Equivalent: $133

Best for who

- Individual Investors: Ideal for self-directed traders who prefer a do-it-yourself approach and want to access a wealth of market scenarios and data without the need for guided assistance.

- Investment Analysts: Best suited for professionals who require in-depth analysis and alerts from seasoned analysts, along with personalized training to optimize their use of the platform for strategic decision-making.

- Financial Educators: Perfect for educators and trainers who want to leverage comprehensive data and customizable alerts to teach their students about market trends and investment strategies effectively.

8. RockFlow

What is RockFlow

RockFlow is an innovative AI-driven fintech platform designed to simplify and enhance the investing experience. With its AI assistant, Bobby, users can effortlessly build portfolios, execute trades, and stay informed about market trends, all while leveraging advanced data analysis and institutional-grade models. The service’s main value proposition lies in making trading accessible, smart, and enjoyable for both novice and experienced investors.

Features

- AI-driven portfolio management that executes trades and optimizes strategies based on extensive data analysis

- Instant access to market trends and potential risks through real-time social media monitoring

- Smart trading partner matching that connects you with top traders for enhanced investment collaboration

- Simplified trading process where you can delegate orders to Bobby, your 24/7 investing assistant

- User-friendly app designed for both novice and experienced investors to trade smarter, faster, and with confidence

Pros and Cons

Pros:

- Seamless AI-driven portfolio management and trade execution

- Access to real-time insights from social media and market trends

- 24/7 availability of AI assistant for continuous support

- Ability to match with top traders for enhanced investment strategies

Cons:

- Dependency on AI may limit personal trading experience

- Potential for information overload from numerous data streams

- May not cater to highly specialized investment strategies or niches

Price

- Free Tier: Limited access to basic functionality with no transaction fees on trades below $1,000

- U.S. Stocks:

- Fractional Share Commission: $0.0035/share (min. charge $0.20, max. charge 1% of trade value)

- Whole Share Commission: $0.0035/share (min. charge $0.50)

- Platform Fee:

- Fractional Share Platform Fee: $0.0038/share (min. charge $0.20)

- Whole Share Platform Fee: $0.0038/share (min. charge $0.50)

- Contact sales for custom pricing and dedicated solutions for high-volume trading or enterprise needs.

Best for who

- Individual Investors: Ideal for those looking to simplify their investment process with AI-driven portfolio management and trading assistance, ensuring they never miss out on market opportunities.

- Small Financial Advisors: Perfect for advisors aiming to enhance client services by leveraging AI analytics and trade execution capabilities, allowing for optimized investment strategies tailored to individual client needs.

- Tech-Savvy Traders: Excellent choice for active traders who want to harness AI to identify trends, uncover deals, and manage trades efficiently, enabling them to stay ahead in fast-paced markets.

Key Takeaways

- Research thoroughly before choosing an AI stock analysis solution – not all platforms offer the same level of sophistication and accuracy.

- Consider your specific trading style and investment goals when evaluating AI tools to ensure they align with your needs and strategies.

- Start with free trials when available to test the AI’s predictive capabilities and user interface before committing financially.

- Read user reviews and testimonials to gauge the effectiveness and reliability of the AI solutions in real-world trading scenarios.

- Stay updated with the latest advancements in AI stock analysis technology to leverage new features that can enhance your trading performance.

- Don’t overlook the importance of customer support and educational resources, as they can significantly impact your experience and understanding of the tool.

- Consider scalability and integration with other financial tools when selecting an AI stock analysis solution to accommodate your future trading growth and diversification.

Conclusion

As we conclude this exploration of the top 8 AI stock analysis solutions, it’s clear that the market offers diverse options to meet various needs and preferences. The key to success lies in understanding your unique requirements and finding the platform that provides the best balance of features, usability, and value for your investment strategy. Each of the solutions highlighted brings innovative capabilities, whether through advanced predictive analytics, real-time data processing, or user-friendly interfaces that cater to both novice investors and seasoned professionals.

We encourage you to use this guide as a starting point for your research, but remember that the final decision should be based on your hands-on experience with these tools. Take the time to explore trials and demos to find the platform that resonates with your investment style and goals. The future of AI stock analysis is bright, and choosing the right solution now can position you for success in the years to come. Dive in, explore the options, and empower your investment journey with the right AI tools!